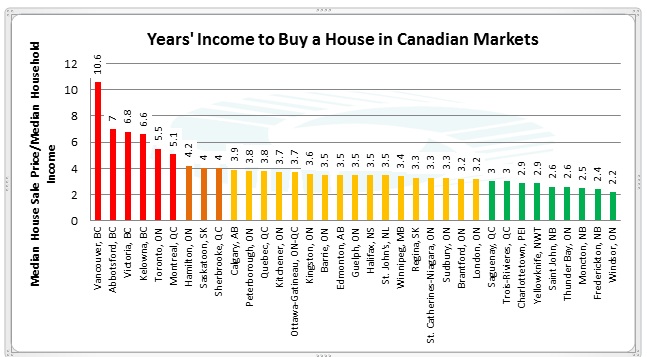

Regina –This morning the Frontier Centre for Public Policy is releasing the 8th Annual Demographia International Housing Affordability Survey. The survey compares the ease or difficulty with which residents of 325 housing markets in seven English speaking countries afford housing. It includes 35 housing markets in Canada (see figure 1).

Figure 1: Years’ worth of median household income required to purchase median Canadian house in selected housing markets (3rd Qtr 2011)

Local Observations:

- Vancouver: Moves to second most unaffordable housing market in the English speaking world as median house prices increase by the equivalent of 1.1 year’s median income;

- British Columbia: Continues to have Canada’s most unaffordable housing. The four British Columbian markets studied are the first, second, third, and fourth least affordable housing markets out of 35 Canadian markets studied;

- Alberta and Saskatchewan: Edmonton, Calgary, and Regina stabilize after the boom and bust of the last five years, however Saskatoon remains an outlier classified as “seriously unaffordable” in international terms;

- Montreal, Toronto and Winnipeg: Inexorably lose affordability, as they have for the past five years;

- Windsor: Remains Canada’s most Affordable metropolitan market at 2.2 years’ income to buy a house;

- Atlantic Canada: Remains Canada’s most affordable region.

Key Themes Emerging from Eight Years of the Survey:

As the survey matures, it covers more housing markets and some of the trends it reveals become stronger:

- As a country Canada still has more affordable housing than all countries surveyed except the United States (more affordable than Australia, Hong Kong, Ireland, New Zealand and the united Kingdom) but there has been a gradual trend towards reduced affordability over time with prices rising slightly faster than incomes;

- Housing affordability is very clearly a local matter. Despite facing the same interest rates, mortgage rules, and federal taxes, housing in Vancouver is five times more expensive –relative to incomes—than it is in Windsor, with the other thirty three Canadian markets spread between these extremes;

- The international evidence is increasing that the most important of the local factors influencing housing affordability is the urban planning regime adopted by local governments. As the author of this year’s Survey Introduction, Dr Robert Bruegmann of the University of Illinois, writes:

I think it is fair to say that a growing number of people who have looked at the figures have tended to agree that a good many well-meaning policies involving housing may be pushing up prices to such an extent that the negative side-effects are more harmful than the problems the policies were intended to correct. These observers have also noted that measures that restrict land supply, slow growth in the immediate area where the policies are in place and push up housing prices can be very attractive to individuals who already own their own homes. (see the full survey for Dr Bruegmann’s full introduction)

- Finally, housing in over half of Canadian markets is more expensive than it needs to be. From World War II through to the 1980s and 1990s, western nations were able to maintain affordable housing at less than three years’ worth of income. It has only been since local governments have begun to impose restrictive land use plans that shortages of housing leading to price rises have occurred. There exists the potential for policy makers to make housing dramatically more affordable for up and coming generations by releasing more land for the building of housing.

How the Survey Measures Affordability:

The Survey compares the median household income in the market to the median house sale price. For example in Vancouver –the hardest place in Canada to afford a house- the median house sale price is $678,500. Dividing this by a median household income of $63,800 gives a Median Multiple Ratio of 10.6. Meanwhile in Windsor –the easiest place— the median house price is $149,900 which, compared to a median household income of $67,900, gives a Median Multiple Ratio of only 2.2.

DOWNLOAD THE FULL REPORT HERE: /publication.php/4053

For further information, media (only) should contact

David Seymour, Senior Policy Analyst, Frontier Centre for Public Policy,

Regina, SK

Email: seymourd@fcpp.org

Tel +1 (306) 581-1007

Wendell Cox

St Louis, Illinois, USA

Email: demographia2@earthlink.net

Tel +1.618.632.8507 United States

GLOSSARY AND TECHNICAL NOTES

- The Median Multiple is calculated from the median household income and median house sale price in each market. The median household income for each Canadian market is before tax. It is sourced from the Census and extrapolated between census years using economic growth figures. The median house sale price is taken from house sale figures in the third quarter of 2010;

- Because the Median Multiple is an income-based ratio, differences in income are already allowed for in the methodology. Differences in affordability reported in this survey, therefore, do not inadvertently reflect income differences.

- “Metropolitan Markets” are defined as areas of contiguous economic activity rather than municipal boundaries. For example the cities of Vancouver and Burnaby are both included in the Vancouver market, whereas Victoria is a separate market.