One of the principal advances of the past two centuries has been the drastic reduction in poverty and the rise of a large middle-class, a process expertly detailed by economists Diedre McClosky and Robert Gordon. At the heart of this trend was the increase in the home ownership rate among the rapidly growing metropolitan population, which increasingly located in the suburbs, where land and houses were less expensive per square foot and which had good access to jobs, shopping and recreation.

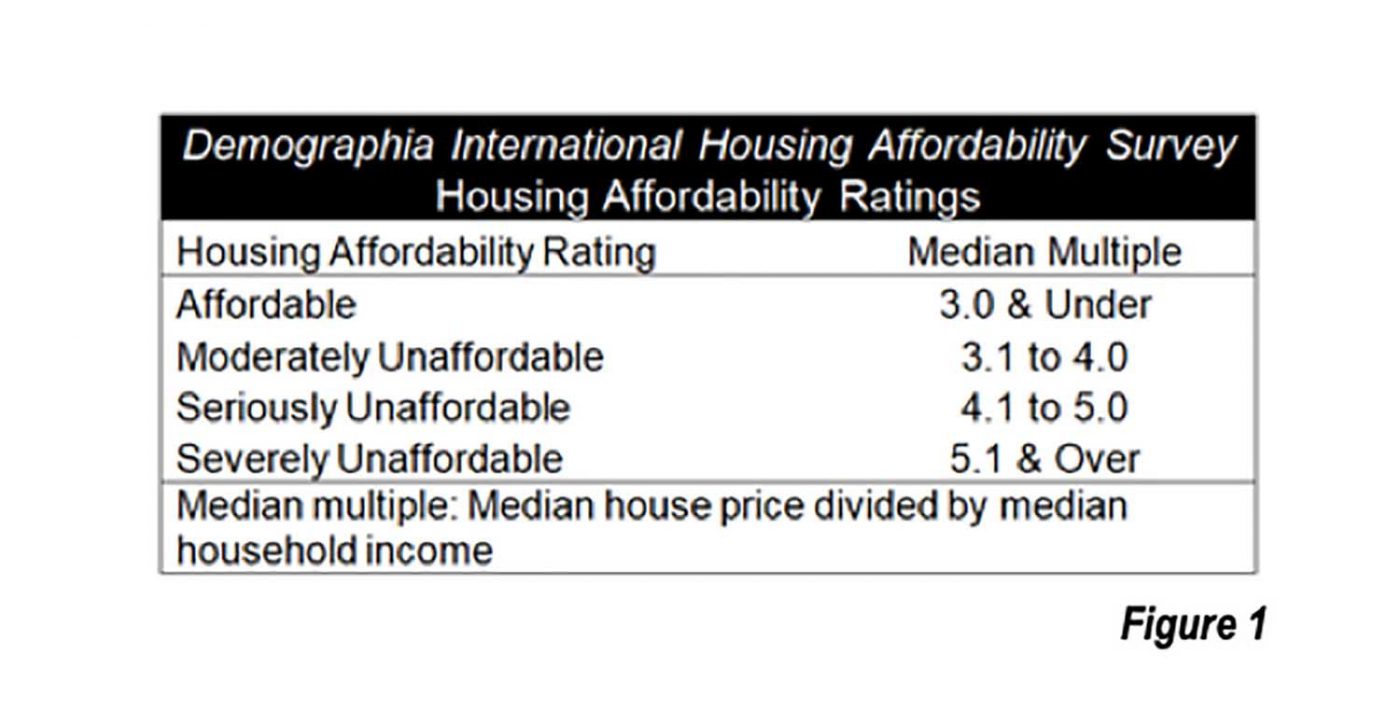

For 16 years, the Demographia International Housing Affordability Survey has rated housing affordability for metropolitan areas (which are both housing and employment markets) in multiple nations. Genuine analysis of housing affordability requires consideration of house prices in relation to household incomes. The Demographia Survey uses the Median Multiple,the median house price divided by the median household income to rate housing affordability (Figure 1).

This article summarizes the 16th Annual Demographia International Housing Affordability Survey, including extracts.This year’s survey also includes an introduction featuring Singapore’s innovative and successful housing policy (“Focus on Singapore,” (Note 1) and a report on housing affordability in Russia (Note 2).

Housing Affordability in 2019

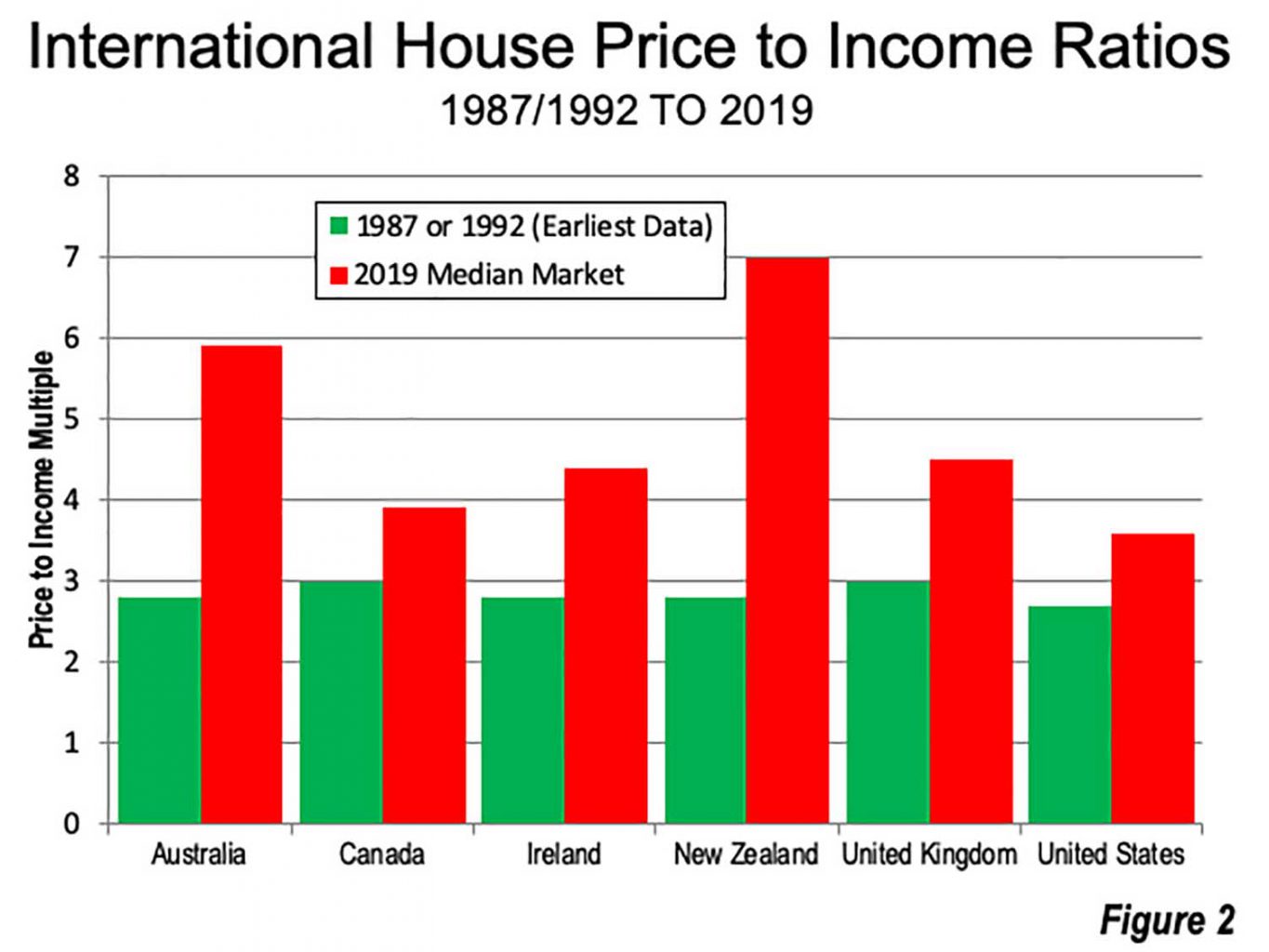

The Demographia Survey indicates that housing affordability has generally deteriorated over the last three decades in the 8 nations covered.By contrast, as late as three decades ago, (Figure 2) the national Median Multiples were “affordable” (3.0 or less) in six of the nations (Australia, Canada, Ireland, New Zealand, the United Kingdom and the United States).

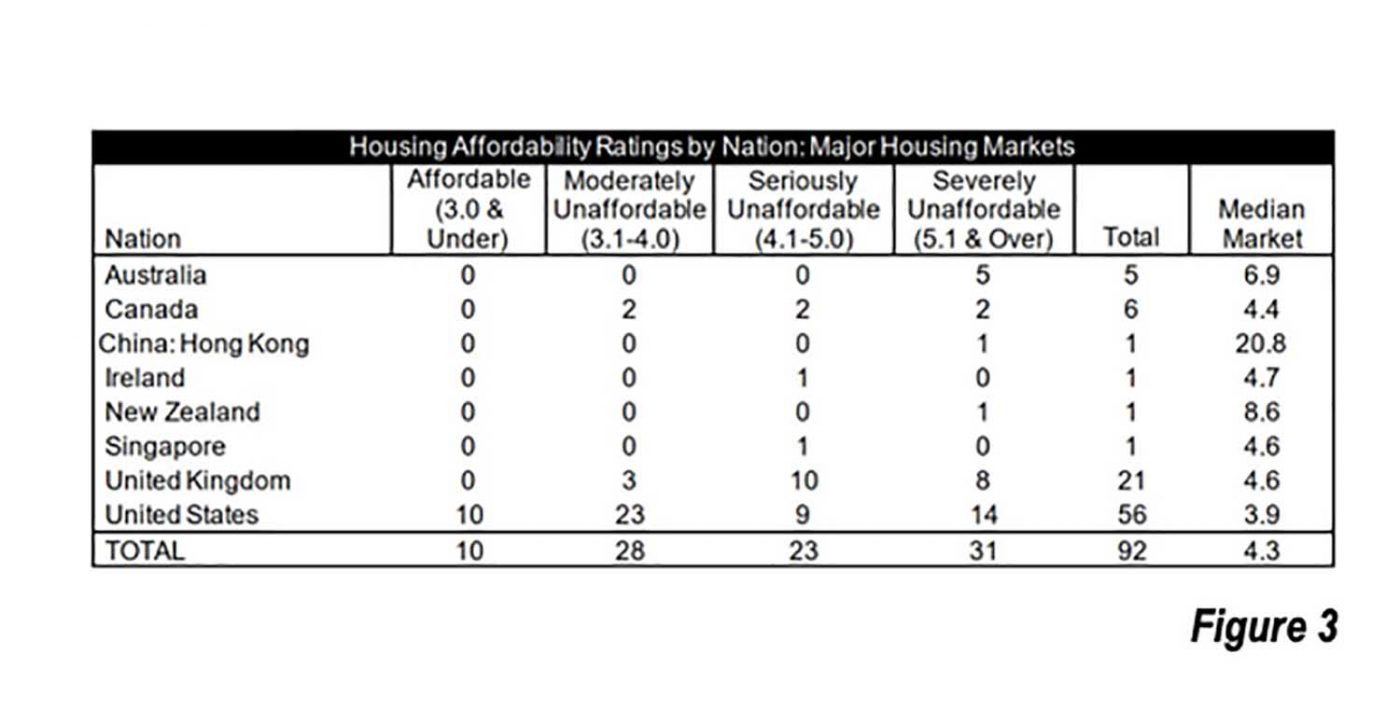

The housing affordability ratings are summarized by nation in Figure 3

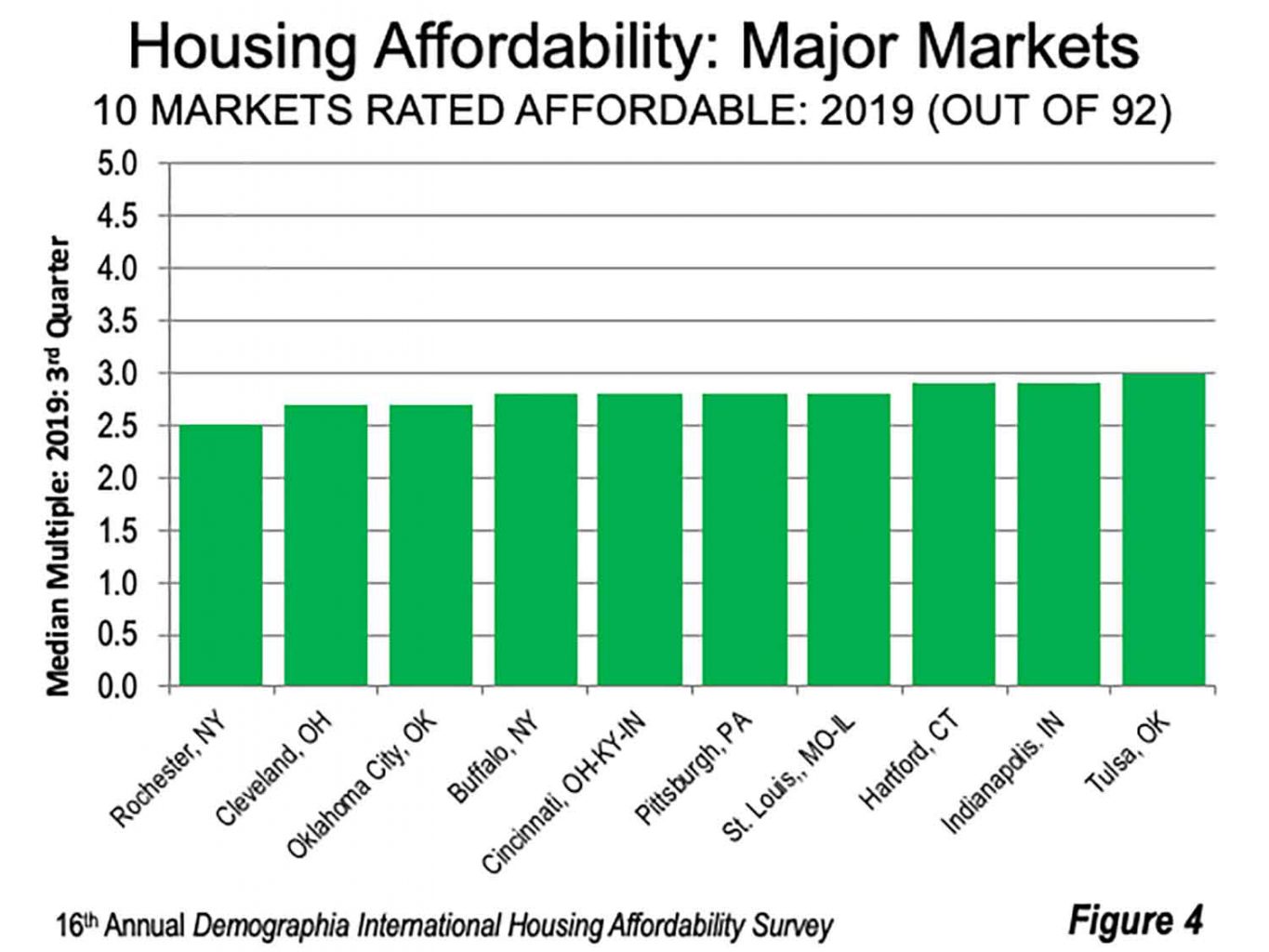

Nonetheless, 10 of the 92 major markets remain affordable, all of them in the United States (Figure 4). The affordable major housing markets include Rochester, with a Median Multiple of 2.5, followed by Oklahoma City and Cleveland (2.7), Buffalo, Cincinnati, Pittsburgh and St. Louis (2.8), Indianapolis and Hartford (2.9) and Tulsa (3.0).

the least affordable metropolitan areas, however, there has been considerable house price escalation relative to incomes, which has been associated with urban containment regulation.

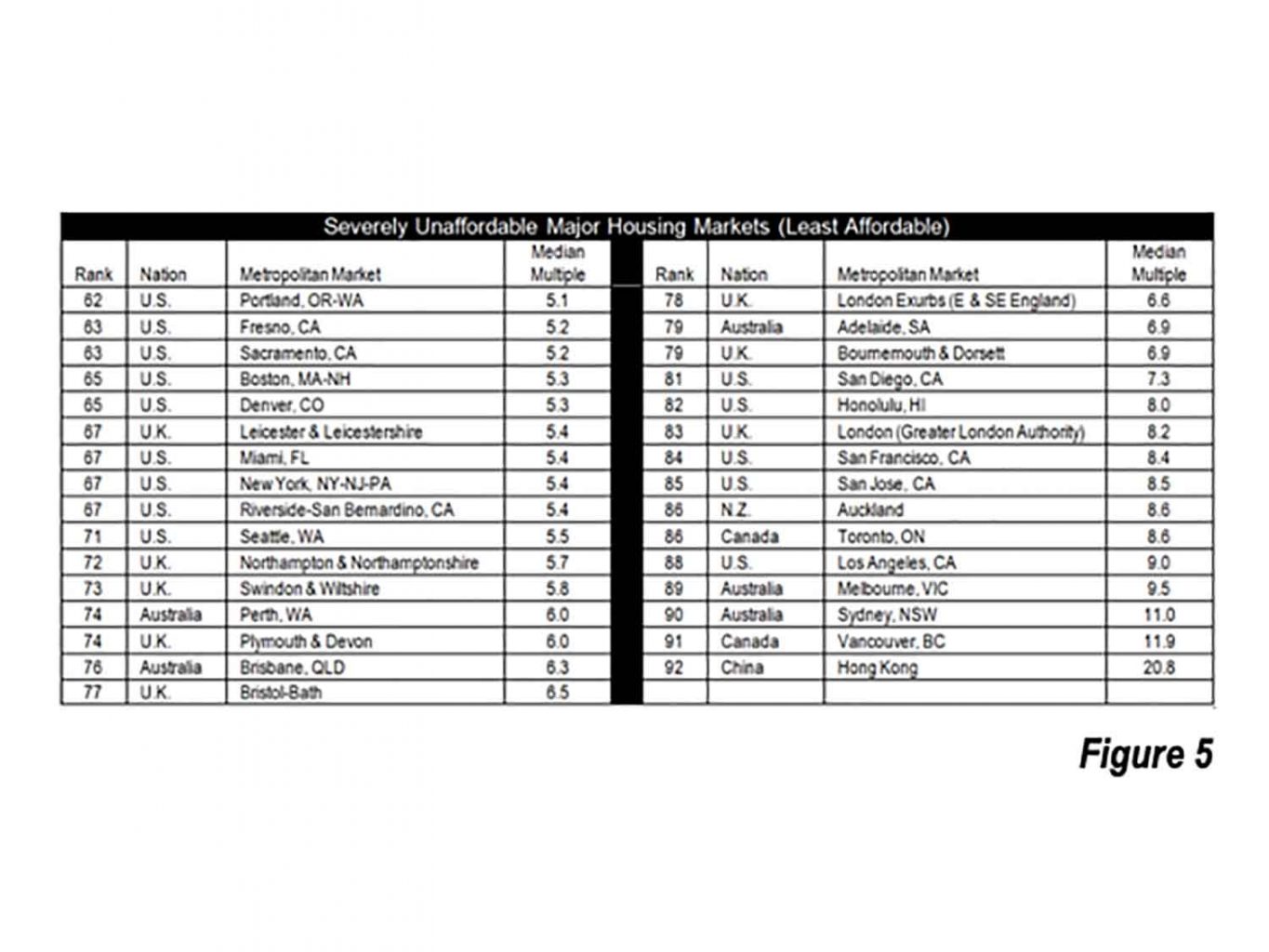

There are 31 severely unaffordable major housing markets in 2019 out of a total of 92 (Figure 5). Hong Kong is the least affordable, with a Median Multiple of 20.8. Vancouver is second least affordable major housing market, with a Median Multiple of 11.9. Sydney ranks third least affordable, at 11.0, followed by Melbourne, at 9.5 and Los Angeles, at 9.0. Toronto and Auckland are tied for sixth least affordable, at a Median Multiple of 8.6. San Jose has a Median Multiple of 8.5 and San Francisco 8.4. London (Greater London Authority) has a Median Multiple of 8.2 and is the 10th least affordable major market.

Where Middle-Income Households Cannot Afford Middle-Income Housing

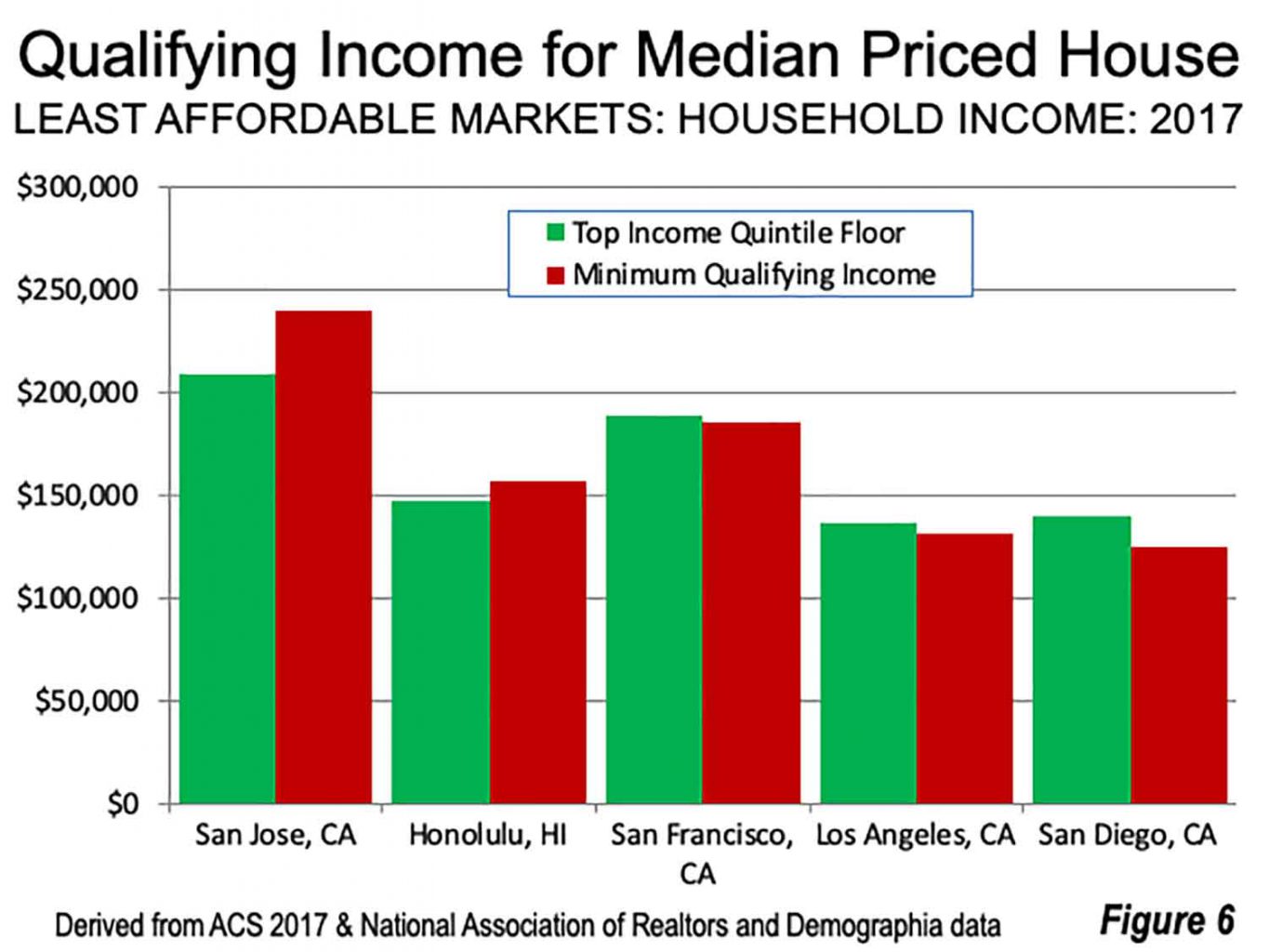

The deterioration in housing affordability has made it nearly impossible for middle-income households to purchase the median price home, at least in the most unaffordable metropolitan areas. For example, in the United States, middle-income households (in the second through fourth income quartiles) did not have sufficient income in 2017 to qualify for a mortgage on the median priced house under typical financial terms in San Jose and Honolulu. Only top quintile (high-income) households qualified. The situation is nearly as dire in the San Francisco, Los Angeles and San Diego metropolitan areas (Figure 6).

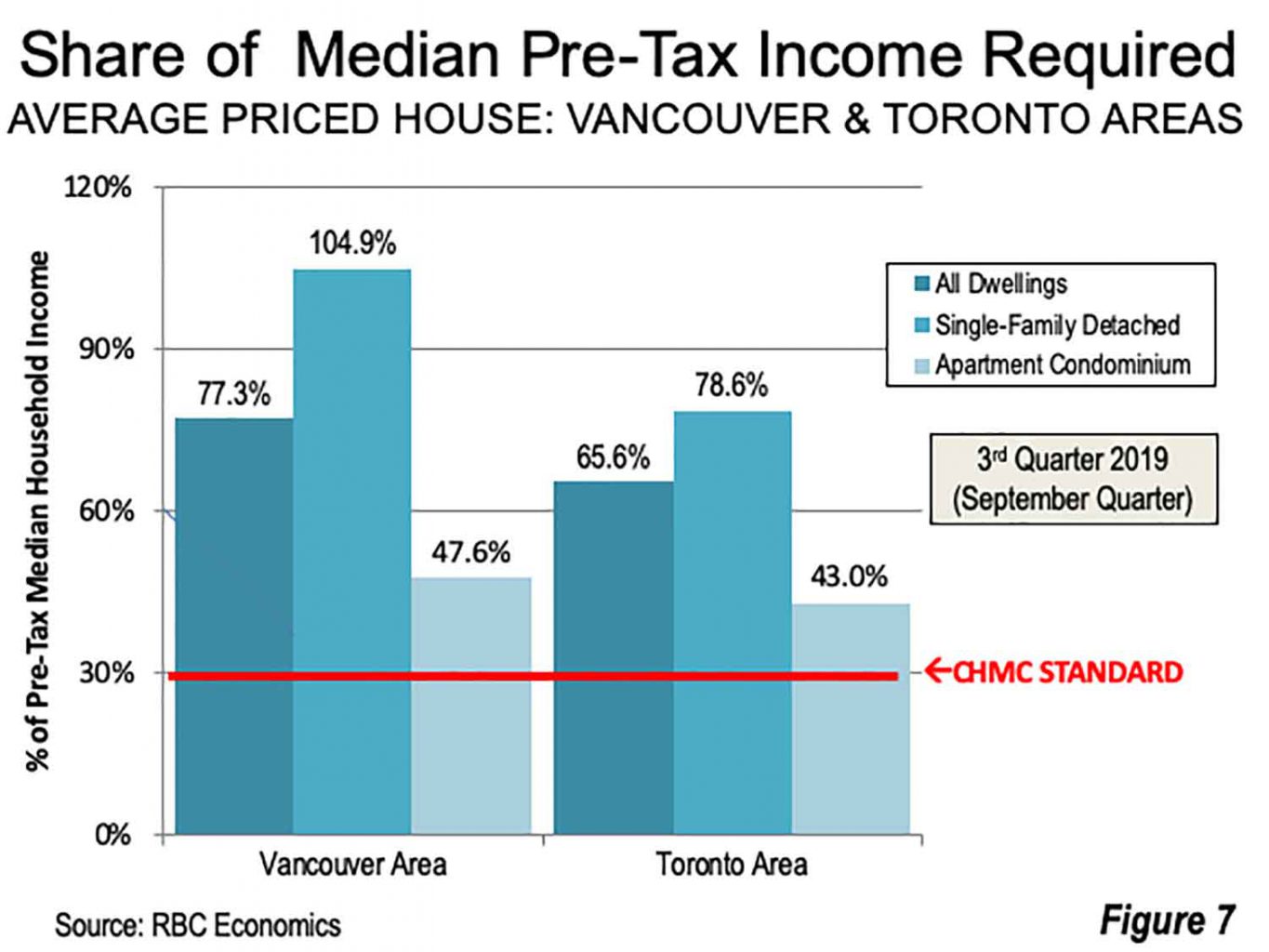

In the Vancouver and Toronto metropolitan areas, middle-income households face similar barriers (Figure 7), as they do in other severely unaffordable metropolitan areas.

The Standard of Living Crisis

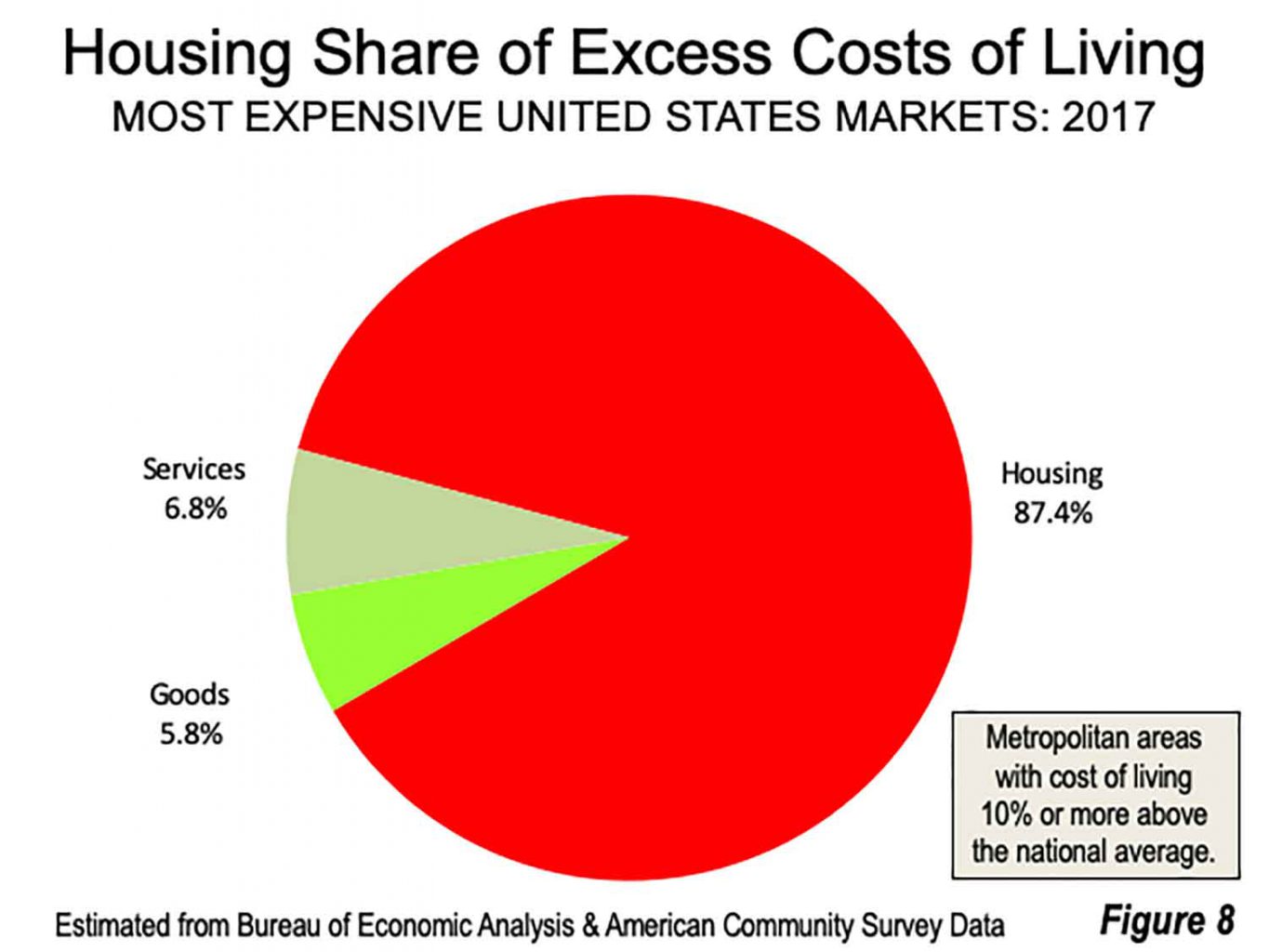

This housing affordability crisis is really a standard of living crisis, since the higher costs of living in the expensive metropolitan areas are largely attributable to higher housing costs (Figure 8).

This conclusion is supported by the analysis of the Organization for Economic Cooperation and Development (OECD), in its recent report, Under Pressure: The Squeezed Middle-Class. OECD finds that the middle-class faces ever rising costs relative to incomes and that its survival is threatened. Again, the cost of housing is the issue. According to OECD, “Housing has been the main driver of rising middle-class expenditure.” Further, OECD notes that that the largest housing cost increases are in the costs of ownership, rather than rents.

The middle class used to be an aspiration. For many generations it meant the assurance of living in a comfortable house and affording a rewarding lifestyle, thanks to a stable job with career opportunities. It was also a basis from which families aspired to an even better future for their children. At the macro level, the presence of a strong and prosperous middle class supports healthy economies and societies. Through their consumption, investment in education, health, and housing, their support for good quality public services, their intolerance of corruption, and their trust in others and in democratic institutions they are the very foundations of inclusive growth. However, there are now signs that this bedrock of our democracies and economic growth is not as stable as in the past.

The report further noted that households of the millennial generation are being “squeezed out of the ranks of the middle class” in advanced economies around the world.OECD expresses concern that “there are now signs that this bedrock of our democracies and economic growth is not as stable as in the past.”

Adult Children to be Less Affluent than Parents

An important characteristic of the historic transition to middle-income affluence has been that children have generally had higher incomes than their parents. In his The Moral Consequences of Economic Growth, Harvard University economist Benjamin Friedman expresses the issue:

…what matters most is not so much how people’s incomes and living standards compare to the year before or even the year before that but whether the average citizen can see the evidence of progress over the last decade or even over the last generation: whether people have a sense of getting ahead compared to how their parents live, and whether their experience gives them confidence that their children will do even better.

Yet, consistent with OECD’s findings, there are indications that this is no longer the case in (at least) the United States, the United Kingdom, Canada, Australia, New Zealand, Ireland and elsewhere. A recent United Kingdom study indicates that millennials will be the first generation to be worse off than their parents since the 1800s.

National economies have already been injured. In talking about his nation’s housing affordability problem, New Zealand’s Minister of Urban Development Phil Twyford referred to “the consequences of this market dysfunction have had a harmful systemic effect on the health of our urban economies.” Similar points have been made on the consequences of restrictive land use regulation on national economies and inequality, such as by Herkenhoff, Ohanian and Prescott (2017), and Hseih and Moretti (2015) as well as by La Cava (2016).

Facilitating better standards of living should constitute the principal domestic policy priority. This requires urban policy that focuses on “people rather than places,” as Paul C. Cheshire, Max Nathan and Henry G. Overman of the London School of Economics have posited. Planning requirements that undermine prosperity need to be eliminated. It took millennia to create the incomparably broad prosperity of the modern middle-class. Where a prosperous middle-class remains it is worth preserving and where it has been lost it should be restored.

16th Annual Demographia International Housing Affordability Survey.

Note 1: The Introduction, “Focus on Singapore,” describes that nation’s more than half-century commitment to ensuring middle-income housing affordability. The lesson of Singapore for the world is not so much the intricacies of its housing market design. Rather, it is that Singapore pro-actively and successfully prioritized affordable home ownership for its citizens, and developed means to accomplish that objective based upon its unique conditions.

Note 2: The Demographia Survey summarizes data from a report by The Institute for Urban Economics (IUE) in Moscow Housing affordability in the major Russian metropolitan areas:3rd quarter 2019. IUE finds that two of the 17 metropolitan areas have Median Multiples that are seriously unaffordable, three that are moderately unaffordable and 12 that are affordable. The median market has a Median Multiple of 2.6. Moscow, now Europe’s largest metropolitan area with 17 million population, has a Median Multiple of 4.2.

Wendell Cox is a Senior Fellow with the Frontier Centre for Public Policy with expertise in housing affordability and municipal policy.

Republished from www.newgeography.com