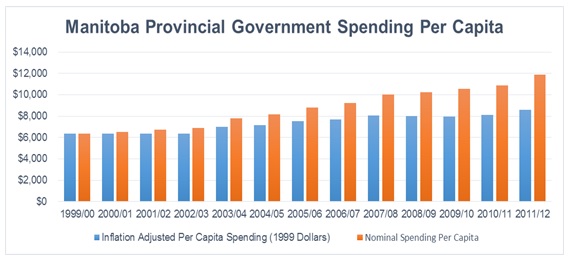

With provincial government expenditures rising far in excess of inflation since 1999, Manitoba does not have a case for raising any of its taxes, which are among the highest in Canada. The province clearly has a spending problem, not a lack of revenue problem, and simply needs to manage spending in more innovative and smarter ways.

- In Fiscal Year 1999/2000, Manitoba’s government spent $6, 379 per resident of the province. By 2011/2012, per capita spending had grown in nominal terms to $11, 867. This represents an increase in government spending per capita of 86 per cent.

- This growth in per-capita government spending has been much faster than the rate of inflation during the same period. This means that “real spending” per capita in Manitoba has been growing steadily.

- The fact that government spending growth has outstripped inflation has punched a hole in the provincial government’s finances. If per-person provincial government spending since 1999 had been held to the rate of inflation, the province would now be saving billions of dollars per year.

- In fact, if per person government spending growth were held to the rate of inflation, Manitoba’s spending in 2011/2012 would have totaled just $10.7 billion. Instead, thanks to faster-than-inflation spending growth over more than a decade, Manitoba spent $14.8 billion in that fiscal year.

- If Manitoba had held per-capita spending growth to the rate of inflation since 1999/2000, the province would have saved $4.1 billion in the last fiscal year alone. By holding real per capita spending constant during the time period examined here, the government could have saved $22.2 billion compared to what was actually spent between 1999 and today.

- One factor that has fuelled spending growth in Manitoba is large cash transfers from the Federal government. In 1999 transfer payments accounted for just over 28% of Manitoba’s revenue – in 2012, this number has increased to 31%.

- In addition to federal transfers, another factor that has caused the deficit to swell has been the government’s willingness to take on new debt. Government debt grew from $10 billion in 1999 to about $23 billion in 2012.

- If the government had managed to hold per-capita spending growth to the rate of inflation, the savings would have been equivalent to the entire amount of personal income tax paid by Manitobans in the 2011/2012 fiscal year.

- With government expenditure rising 86% above the 1999/2000 base year, the provincial government does not have a case for raising any of its taxes. Manitoba clearly has a spending problem, not a lack of revenue problem and simply needs to manage expenditures so they are more in line with normal economic growth.

Read in PDF format here.