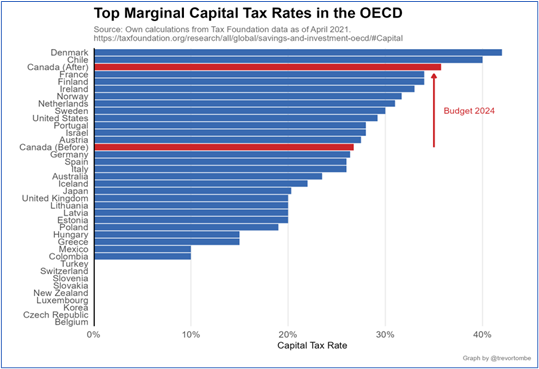

Canada Now has the Third Highest Global Capital Gains Tax Rate

- The April 16th federal budget increased Canada’s inclusion rate for capital gains, sharply moving Canada up in the effective marginal capital gains tax rate versus rival nations.

- According to University of Calgary economist Trevor Tombe, the recent federal budget dramatically pushes Canada near the top of having the world’s top effective marginal tax rate on capital gains. Canada effective capital gains tax rate moved from 13th to third highest in the world.

- Increasing the inclusion rate of capital gains from 50% to 66.67% raises the effective top marginal tax rate on capital gains in Canada from (examples) a low of about 24% in Saskatchewan to 32%; and from a high of 26.5% in British Columbia to 35.5%.

- Corporate profits are already taxed separately, capital gains tax is on top of it. Corporations are not just big publicly-traded ones, but small ones: for example, physicians’ practices would be hurt badly with the new capital taxation change.

- The Council of Canadian Innovators and the Venture Capital and Private Equity Association of Canada warn that this proposed higher capital tax regime will harm investment and growth. Countries with lower or ideally no capital gains taxes attract more investment both from domestic entrepreneurs and foreign investors. Canada has lagged badly in attracting investment capital in recent years. These increases will exacerbate the problem – hurting Canada’s economy and dollar.

- Low levels of investment in the past decade in Canada have resulted in poor productivity growth, and a per capita GDP gap between Canada and the U.S. (~USD$20,800 in 2022). Canada’s government budget estimates projects the capital gains tax increase will affect just 13% of taxpayers and raise nineteen billion dollars over the next 3 years. However, there is substantial evidence that high income individuals change their behaviour in response to tax increases with these types of tax hikes generally yielding less than forecast revenues.

- There are other ways to reduce the deficits for the next three years by nineteen billion dollars or more, particularly reversing record level federal spending increases. Putting spending back to where it was in fiscal 2018-2019, before the pandemic, and adjusting for inflation and population growth, expenses would make program spending $418.2 billion, which is thirty-one billion less than the proposed $449.2 billion and would nearly eliminate the projected deficit.

- One easy way to ‘save’ nineteen billion dollars is to not spend anything further on ‘green energy’ such as battery and electric vehicle plants, and other subsidies and grants for renewable energy and the like, which are estimated to cost ninety-three billion dollars by fiscal 2034-35.

Read in PDF format here.