HOUSING AFFORDABILITY – HOW DOES YOUR CITY RATE?

Frontier Centre for Public Policy releases international survey of housing affordability. Survey compares affordability in 325 housing markets across seven countries –Including 35 in Canada.

INTRODUCTION

The 2011 7th Annual Demographia International Housing Affordability Survey (data 3rd Qtr 2010) has been expanded to 325 urban markets of Australia (32 urban markets); Canada (35); Hong Kong, China (1); Ireland (5); New Zealand (8) United Kingdom (33) and the United States (211). This Annual Survey authored by experts Wendell Cox (U.S.A) and Hugh Pavletich (New Zealand)has been called the “gold standard” for assessing housing affordability of the urban markets it covers. Biographies of both authors are available in the appendix of the main report.

DOWNLOAD THE FULL STUDY HERE

HOUSING SHOULD NOT EXCEED 3.0 TIMES GROSS MEDIAN ANNUAL HOUSEHOLD INCOME

For housing markets to rate as “affordable”, housing should not exceed three times gross annual household income (the Median Multiple). If this “affordability threshold” is breached, it indicates local political impediments to the provision of affordable housing that need to be dealt with.

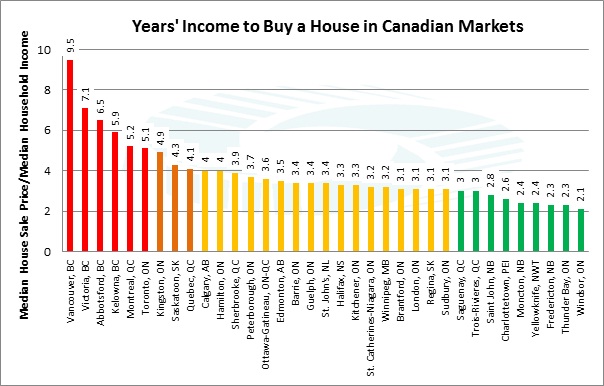

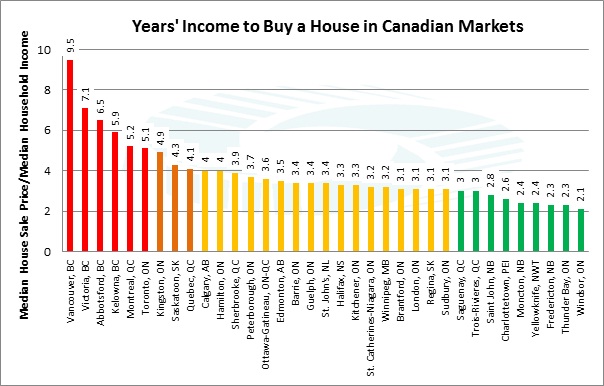

Housing markets are rated as “affordable” at or below 3 times gross annual household income (Median Multiple), “moderately unaffordable” at or below 4 times income, “seriously unaffordable” at or below 5 times income and above 5, rated “severely unaffordable”.

SURVEY INTRODUCTION – ACCLAIMED AUTHOR JOEL KOTKIN

Joel Kotkin, a California based writer on urban issues and executive editor of New Geography, contributed the Introduction “Why Affordability Matters” stating –

“Little discussed have been the social and economic implications of such policies (strangling urban expansion). Although usually thought of as “progressive” in the English speaking world, the addiction to “smart growth” can more readily be seen as socially “regressive”. In contrast to the traditional policies of the left of center governments that promoted the expansion of ownership and access to the suburban “dream” for the middle class, today regressive “progressives” actually advocate the closing off of such options for potential homeowners.”

“……..It is a very dangerous concept, essentially promoting a form of neo feudalism which reverses the great social achievement of dispersing property ownership.”

“…..But perhaps most remarkable has been the shift in Australia, once the exemplar of moderately priced, high quality middle class housing, to now the most unaffordable housing market in the English speaking world.”

The Introductions to earlier Surveys had been provided by Australian environmental scientist Dr Tony Recsei (2010), American housing authority and author Dr Shlomo Angel (2009) and the former long term Governor of New Zealand’s Reserve Bank Dr Donald Brash (2008).

CANADIAN MARKETS

The 2011 survey includes data for 35 housing markets across Canada. These show that:

- Housing is “severely unaffordable” for homebuyers in six Canadian markets. Vancouver is the third most unaffordable of the entire survey behind only Hong Kong and Sydney (Australia);

- Housing affordability is not primarily influenced by national factors such as interest rates or mortgage regulations. Such factors apply evenly across the nation, despite large variations in affordability from market to market. Local factors such as planning laws are the key driver of affordability;

NOTABLE OBSERVATIONS FOR CANADA

- As a nation, Canada has reasonable housing affordability. Around half of the Canadian markets in the survey are either at, below, or very near the affordability threshold of three years’ income to buy a house;

- Broken down into regions, the most affordable market in Canada, Windsor, ON, is almost five times more affordable than the least affordable, Vancouver, B.C. Vancouver is also the third most unaffordable market out of 325 housing markets worldwide;

- Four out of the six severely unaffordable markets are in British Columbia;

- Montreal is less affordable than Toronto for the first time in this index;

- Saskatoon is less affordable than both Calgary and Edmonton, something that would have been unthinkable only five years ago. Saskatchewan has been losing affordability throughout its recent economic renaissance.

AFFORDABLE HOUSING MARKET DEFINED

“For metropolitan areas to rate as “affordable” and ensure that housing bubbles are not triggered, housing prices should not exceed 3.0 times gross annual household earnings. To allow this to occur, new starter housing of an acceptable quality to the purchasers, with associated commercial and industrial development, must be allowed to be provided on the urban fringes at 2.5 times the gross annual median household income of that urban market (refer Demographia Survey Schedules for guidance).”

“The critically important Development Ratios for this new fringe starter housing should be 17 – 23% serviced lot – the balance the actual housing construction.”

The fringe is the only supply / inflation vent of an urban market.”

There is a truism, well understood by responsible developers and real estate financiers internationally –

“If you get the land price wrong – everything else is wrong.”

Due to unnecessary politically inflated land costs, housing markets are “very wrong” in Hong Kong, Australia, New Zealand, the United Kingdom, Ireland and some parts of Canada and the United States.

DOWNLOAD THE FULL STUDY HERE

For further information, media (only) should contact

David Seymour

Senior Policy Analyst, Frontier Centre for Public Policy

Regina, SK

Tel +1 (306) 581-1007

Wendell Cox

St Louis, Illinois, USA

Tel +1.618.632.8507 United States

GLOSSARY AND TECHNICAL NOTES

-

The Median Multiple is calculated from the median household income and median house sale price in each market. The median household income for each Canadian market is before tax. It is sourced from the Census and extrapolated between census years using economic growth figures. The median house sale price is taken from house sale figures in the third quarter of 2010;

-

Because the Median Multiple is an income-based ratio, differences in income are already allowed for in the methodology. Differences in affordability reported in this survey, therefore, do not inadvertently reflect income differences.

-

“Metropolitan Markets” are defined as areas of contiguous economic activity rather than municipal boundaries. For example the cities of Vancouver and Burnaby are both included in the Vancouver market, whereas Victoria is a separate market.