Imagine a TV world where you can only get the hockey game if you subscribe to Rogers or a new comedy if you subscribe to Shaw. This is one speculation being discussed at this last week’s CRTC’s hearing on vertical integration between cable/satellite distribution companies and the broadcasters, pay and specialty channels.

Rogers/CHUM/SportsNet/CITY

Shaw/Global

Bell/ CTV

Quebecor/Videotron/TVA

These groups, with both distribution and content, now dominate the landscape. Telus, SaskTel, MTS and Cogeco have not joined what some have called “convergence round 2”. Although “convergence round 1”, telecom companies buying up content companies, didn’t end happily for many of the participants, here we are again.

Having approved the acquisitions over the years that resulted in this structure, the CRTC is now having a look at adjusting the rules and regulations that were built for an earlier broadcasting system. What rules will govern how the conglomerates compete with each other and with the remaining independent participants? What does this mean for Canadian viewers?

At this hearing, the big questions are:

Ø How programming owned by distributors is made available to other distributors

Ø How independent programming services obtain carriage on the distributors

Ø What programming packages like basic cable look like

Most Canadians now have access to three or four distribution services – cable, two satellite services and the phone company’s IPTV service. Generally, they all show pretty much the same thing because the CRTC structures it that way. Also, Bell owns one satellite distributor and Shaw owns the other so there are only two owner groups in the system. In any geographic market there is certainly more competition than in the days of one monopoly cable company, but both competitors have significant market power with respect to the independent programming services negotiating terms of carriage.

In the old days each component of the system performed its function and had access to a particular revenue stream in exchange for contributions required to promote Canadian content and production. Cable and satellite companies distributed programming to households and charged subscriber fees based on the packages and additional channels selected. Off-air broadcasters had access to advertising revenue and were carried on the distribution systems. Pay and specialty channels were added with various combinations of additional subscriber fees and advertising revenue. The CRTC determined what was included in the basic package, and to a large degree how the other packages were put together, making sure that there was plenty of Canadian programming at each level.

For most programming services, once the CRTC issued a licence, the distribution companies had to carry the channel. Only the last category known originally as Category 2 digital specialty channels had to negotiate whether they would be carried at all by the distribution companies. The others only had to negotiate terms and conditions within the rules set by the CRTC. This is why there is really very little difference in the programming packages offered by the cable and satellite companies. There is plenty of tinkering around the edges but most of it is pretty much the same.

Broadcasters and specialty channels buy the rights to distribute US programs in Canada and they are required to also distribute specified amounts of Canadian programming. With distributors owning some of the content, other content owners and producers are concerned that distributors will give undue preference to their own content with respect to channel placement, packages and other terms and conditions of carriage. The possibility also arises that distributors will compete by having exclusive programming deals. This would give them advantages over distributors like Telus who do not have their own content. This hearing will determine the rules and regulations for this important new feature of the environment. The old assumption was that each distributor would carry pretty much the same thing. That assumption is disappearing.

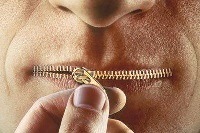

While the distributors who own content argue for limited regulation, to promote a competitive environment in content it is in the consumer’s interest to ensure that independent competitive programming services and production continue to have access to distribution on reasonable terms.

All of the distributors are also Internet Service Providers (ISP’s). As more people watch video over-the-top, meaning through their Internet connection, the distributors are losing lucrative “cable” revenue. Both cable companies and the telephone companies will be selling video service packages on the traditional cable model down the same pipe that they are selling Internet access. Here again there is opportunity for self-dealing and undue preference. Other proceedings will be dealing with these issues but they are all connected.

In the longer run, the acquisition of broadcasters may be a strategic mistake. Canadian broadcasters are still making good money according to the most recent release of financial results but the growth of Internet video threatens that position. If Internet video continues to gain market share over what has been called appointment TV, then the broadcasters’ traditional role of assembling programming into a channel and the cable company’s traditional role of assembling channels and distributing them will lose value to the consumer. New models will be created and the battle for access capacity to consumer households will be a major factor in who succeeds.