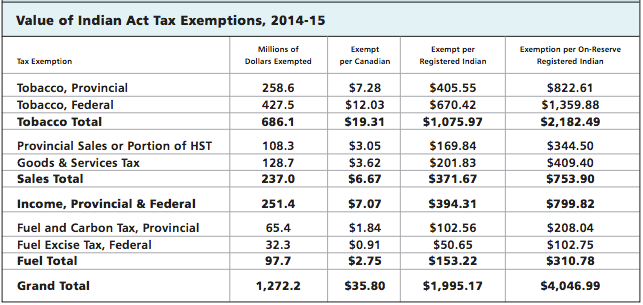

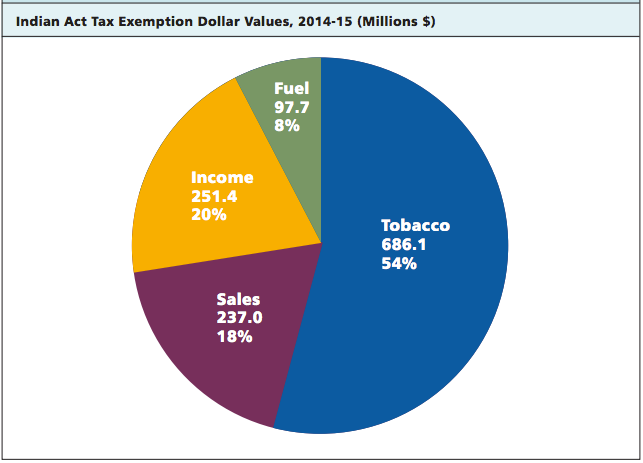

All Canadian provinces face mounting health expenditures, owing in part to smoking. Yet, tobacco products sold on First Nations reserves is not subject to taxes, unlike off-reserve sales. Even though exemptions are not enshrined in the Indian Act, the constitution, or in any treaty, they are no federal tax on tobacco on reserves.

According to a new research paper, led by the Atlantic Institute for Market Studies (AIMS) and co-published with the Frontier Centre for Public Policy (FCPP), the value of the tobacco exemption for First Nations reserves across Canada is $686-million. Author Lee Harding estimates that the cost of all exemptions – for tobacco, fuel, income, and sales taxes – is about $1.3-billion.

The Value of Tax Exemptions on First Nations Reserves is the first study of its kind. The report includes sections on all Canadian provinces, giving a national picture of the cost of tax expenditures. Harding recommends that tax exemptions on reserves be phased out, especially those on tobacco.

“The numbers we present in this study are significant,” said Frontier Centre President and CEO Peter Holle, who said that “there is definitely an incentive for increased smoking on First Nations because they can buy tobacco at discount prices. As a result, governments are, in fact, subsidizing smoking for these people which results in higher health-related costs.”

In the report, Mr. Harding discusses the difficulty he had in getting data for examining this issue. While information for tax exemptions for non-aboriginals is readily available in public databases, basic data on Aboriginal tax exemptions require Access to Information requests, directed at sometimes-uncooperative agencies. The study recommends that governments improve data collection for First Nations tax exemptions.

Read the entire study here: FC199-17011_TaxExempt_JN2817_F2