“Those that fail to learn from history are doomed to repeat it.” – Winston Churchill

Background

On January 9, 2000, then-President Jamil Mahuad announced the official adoption of the monetary system of dollarization, having unleashed a spontaneous process. In January of this year, dollarization turned 21 years old. This transformation came from civil society after a severe crisis caused by a statist economic model that was implemented since 1972. Some economic policies are in force until today, when the military dictatorship controlled all the functions of the State. Subsequently, the governments during that time carried out uncontrolled monetary issues within the nineties that caused high levels of inflation.

Let us remember that in the country, before the year 2000, when the Sucre was ruled as the official currency, there were repeated devaluations that reduced the purchasing power of people who, added to other harmful economic policies, produced a high level of poverty (22.9 percent of Ecuadorians lived on less than $3.20 per day). The U.S. currency in the country particularly deprived the governments at that time the handling of monetary policy, allowing them to stop high inflation levels, improve fiscal discipline, and restore credibility. Interest rates also fell drastically, poverty was reduced (10.2 percent in 2003 and 3.2 percent in 2019), making it possible for businesses to implement long-term plans and focus on increasing productivity.

In Ecuador, certain structural problems persist that are a consequence of not having a dollarized economy, rather, they are due to the presence and intervention of the Central Bank and the issuance of internal debt of the government. Furthermore, the barriers of entry for potential participants in the financial market are operational and administrative inefficiency, legal instability, among other regulations and taxes. All these elements exert direct or indirect pressure on interest rates in the Ecuadorian financial market.1 The objective of this writing is to analyze what must be done to correct those structural problems that will help the country’s reactivation, recovery, growth, and socio-economic development.

The main economic problem in Ecuador is the lack of generation capital and savings. In Ecuador something particular happens, it is that domestic saving is scarce. This is due to low productivity that does not allow for higher wages and higher taxes that cause the cost of living to be higher and limit savings. By having higher productivity, higher levels of income, and greater capacity to save, these conditions will create an environment to push interest rates to a lower bound. Additionally, the few existing savers in the financial system are those who may support the loans granted to individuals and companies that qualify to get one.

The main economic problem in Ecuador is the lack of generation capital and savings. In Ecuador something particular happens, it is that domestic saving is scarce. This is due to low productivity that does not allow for higher wages and higher taxes that cause the cost of living to be higher and limit savings. By having higher productivity, higher levels of income, and greater capacity to save, these conditions will create an environment to push interest rates to a lower bound. Additionally, the few existing savers in the financial system are those who may support the loans granted to individuals and companies that qualify to get one.

Some of the structural reforms that will contribute to the reduction of interest rates correlated to this are: reduction of the income tax, elimination of taxes on international money transfers, reduction of the tariffs of import, change in the Labor Code, and abolition of the employee’s participation on businesses’ profits. Moreover, elimination of price controls, opening of all sectors to competition, reforming the pension system (savings invested today, multiplied for tomorrow) and tax simplification.2

Current Situation

Now, analyzing what happens with interest rates, we see constant clamor in Ecuadorian citizens who demand lower interest rates, however, many people are unaware that they are regulated by the Central Bank of Ecuador with the participation of the government. Interest rates are fixed based on different segments and subsegments in the national financial system due to the fact that there is a maximum to be charged to lenders based on this. In this year’s electoral campaign, some political actors agreed that necessary measures had to be taken to lower interest rates, but some analysts have insisted that this cannot be achieved by presidential decree and even worse by some law passed through Congress. Consequently, in the hypothetical case that interest rates are artificially lowered, it would be harmful for a smaller number of economic agents to obtain financing. It would also cause the supply of credit to be reduced because it could become unattractive to some lenders.

When artificial reduction in interest rates occurs, a shortage of credit could be generated, especially in the small-sized business segments, due to the lower supply and high demand of funds in the country. In turn, if interest rates were low, it would cause less access to credit because banks would lend to companies and people with greater economic solvency, therefore, small and medium-sized companies or people in general will be the most affected. It should be noted that interest rates must be governed by the market (supply and demand), and these also function as forecasts for eventual economic crises that may occur due to economic cycles.

During the scenario of legal uncertainty, lack of stability in the economy, and risk of default cause interest rates to increase due to uncertainty. It can be anticipated that the current government will not artificially lower interest rates, but what happens in Congress is unpredictable. For this reason, it is essential for the government’s control to end and interest rates to be released through a free market mechanism as in most of the largest western economies.

Effect of COVID-19

The SARS-CoV2 pandemic known as COVID-19 since 2020 unleashed a global health crisis that had an impact worldwide and a contraction of the global economy of 3.5 percent, according to World Bank (WB) in its Global Economic Prospects 2021.3 For 2021, the WB predicts a steady recovery of 5.6 percent in the world economy. The WB also indicates that Ecuador during the previous year suffered a contraction of 7.4 percent compared to the regional average of -6.5 percent, while for this year the country will have a recovery of 3.4 percent compared to the regional average of 5.2 percent, that is expected for the Latin American region. For its part, the Central Bank of Ecuador estimates that the Gross Domestic Product (GDP) for this year will grow by 2.8 percent.

Before the pandemic, Ecuador was already suffering an economic downturn that has worsened. For this reason, it is necessary to achieve international financial integration, which is a mechanism to capture liquidity that is found abroad. This could be achieved by taking advantage of having a strong currency as the U.S. dollar. In this way, the country can obtain resources from international banks. Currently, 24 private banks operate in the country, of which only one is an international Financial Institution (FI).4 It is important to note that Ecuador maintains a solid banking system with good liquidity and solvency indicators, contrary to what happened with some banks that failed in the 1990s. Nevertheless, Ecuador is one of the Latin American countries with the lowest participation of foreign banks,5 while Panama, Peru (Nuevo Sol as currency), and El Salvador (which also has a dollarized economy) have a higher presence of foreign banks in their economies.

Benchmark with other Economies in the Region

Panama is a benchmark country for Ecuador, as it is dollarized. The Caribbean country has taken advantage of this monetary system as it has become an international financial center. With the enactment of a flexible and market-oriented banking law in 1970, Panama was able to connect to global international markets. Today, its economy enjoys an extensive supply of resources with which its citizens have benefited, and these resources do not depend on internal savings. This has allowed it to obtain a great supply of credit as a result of a presence of around 70 banks between national and international FIs. Interest rates in Panama have approached an international rates benchmark given that there is no exchange risk and the inflation rate is low. Fortunately, both elements mentioned before do not occur in Ecuador either.

According to the Central Bank of Ecuador on its Financial Inclusion Statistics Bulletin,6 only 11.8 percent of the population over the age of 15 received credit from a financial institution in 2017. At the corporate level, the figures from the World Bank’s Enterprise Surveys showed that smaller companies are the ones that find it most difficult to access financing in the country.7 According to the aforementioned study, 15 percent of small-sized companies surveyed in Ecuador identify access to financing as a serious restriction, compared to 11 percent of medium-sized companies and eight percent of large-sized companies.8 Indeed, if Ecuador joins the global market effectively, credit conditions would be more favorable, benefiting companies and all businesses that are currently excluded from formal financing.

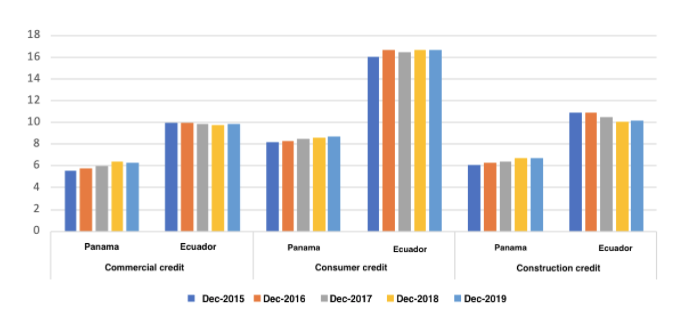

In Graph 1, a comparison is analyzed between the reference lending rates that have been charged in recent years in Ecuador and Panama for commercial credit, consumer credit, and construction credit. It can be analyzed, for each of the types of credit that interest rates in Panama have been significantly lower than those in Ecuador.

The same happens if they are analyzed for commercial credit, they have been close to 6 percent in Panama, while in Ecuador these interest rates have been above 9 percent. For its part, credit for consumption; in contrast, in Panama these have been around 8 percent in the years from 2015 to 2019. In Ecuador, what is charged in this segment can reach interest rates above 16 percent. In the same period, while loans for construction in Panama have been around 6 percent, in Ecuador these reach levels greater than 10 percent.

Although these reference interest rates are not strictly equivalent, because there are differences between the segmentation and sectors from one country to other, they allow us to have a notion as to the reality of the cost of financing; and, it is concluded that interest rates in Panama have been lower than those of Ecuador for the aforementioned benchmarks.

Graph 1. Comparison between active interest rates in Ecuador and Panama

(values in percentages)

Source: Central Bank of Ecuador and Superintendency of Banks of Panama

Information and graphic prepared by: Ecuadorian Institute of Political Economy (IEEP)

The previous graph shows that interest rates for the construction sector in Panama have been between 6 percent and 7 percent in recent years, which has allowed Panamanians from low and middle social strata to access low interest rates with long terms that can be found in other emerging countries. In contrast, the construction sector in Ecuador is relevant for investment and employment. If conditions in real estate credit improve, this sector could be promoted to contribute to the country’s economic recovery.9

In effect, if financial integration is achieved, as suggested by the Ecuadorian Institute of Political Economy (IEEP), society in general would benefit from access to credit that will allow the expansion of businesses. This will provide a more suitable environment for the establishment of new companies and, therefore, new jobs that are urgently needed within the economy.

Twenty-one years ago, the IEEP with its president and founder Dora de Ampuero, among other people within civil society, encouraged the government of that time to make the U.S. currency official in the country. Now, this institution presents a new project called: “Freedom and prosperity Forum: five reforms to empower Ecuador,” which exhibits one of the five points as the objective of an integration of the financial system of Ecuador to global markets, which would be one of the main reforms in the short term to contribute to the recovery and subsequent growth of the country’s economy. The Panamanian experience can serve as an example to adopt.

In short, the IEEP proposes in its study carried out by several analysts that it is necessary to establish reforms at the financial and tax level to make Ecuador an attractive point where international financial institutions consider investing; establish flexible banking legislation, with an international market vision and in harmony with international standards. What is more, eliminate the power of authorities to execute monetary policy and any practice equivalent to financial repression, as well as offering a competitive tax regime, based on a principle of territoriality and with a lower tax burden. It would be an important step for Ecuador to begin to experience some of the benefits that financial integration has occurred in Panama.

In recent days, the Manager of the Central Bank of Ecuador, Guillermo Avellán, indicated that interest rates could fall in October of this year with a new methodology for entrepreneurs and businesses. In addition, the President of Ecuador, Guillermo Lasso, has requested the banks and cooperatives to improve the conditions for consumer and entrepreneur loans. In the coming days, Ecuadorians will be able to obtain more information in this regard.

Conclusion

With all of the foregoing, if interest rates are not liberalized in Ecuador, no foreign bank will want to make its investments in the economy. Therefore, these imposed maximums have to be eliminated. This will also contribute to the current sale of Banco del Pacífico (public bank) to foreign investors as being announced.

It has been suggested to the president not to gradually eliminate the 5 percent of the foreign exchange outflow (ISD) tax, but to do so immediately for the good of the country, because it is one of the main obstacles for the arrival of foreign investment, especially if he wants to attract investment from foreign FIs.

In sum, many changes have to be made to improve the national economy, and it is hoped that Congress will not be an obstacle. Congressmen must understand that, just as prices are a source of information, interest rates are another important component within the markets, and when the government intervenes in its setting, it causes more problems than it intends to solve.

Adriana Yépez Kuri is a research associate at the Frontier Centre for Public Policy.

Endnotes:

- Romero P. “Public Policy Analysis: Interest Rate Conjectures”. 2004.

- Hidrobo A. “Measures to face the crisis and build a prosperous future”. 2020.

- World Bank. “Global Economic Prospects”. Worldbank.org. 2021. Retrieved June 2021 from https://www.worldbank.org/en/publication/global-economic-prospects

- Superintendency of Banks. “Public Registry of the Superintendency of Banks”. 2020.

- Asobanca. “Technical Report: Foreign Banking”. 2019. https://www.asobanca.org.ec/publicaciones/estudios-especiales/informe-t%C3%A9cnico-banca-extranjera ; and Romero, P., & Sandoval, S. “Dollarization does not require an active central bank”. 2019. Koyuntura.

- Central Bank of Ecuador. “The Ecuadorian economy begins the economic recovery with an expansion of 2.8%”. 2021. https://www.bce.fin.ec/index.php/boletines-de-prensa-archivo/item/1431-la-economia-ecuatoriana-inicia-la-recuperacion-economica-con-una-expansion-del-%202-8-in-2021

- World Bank.“Poverty headcount ratio at $ 3.20 a day (2011 PPP) (% of population)”. 2020. https://datos.bancomundial.org/indicador/SI.POV.LMIC.GP?locations=EC

- Ecuadorian Institute of Political Economy, IEEP. “Financial Integration Project in Ecuador”. 2020.

- Ibid.