The International Transactions in Securities monthly report covers transactions in stocks, bonds, and money market securities between non-residents and residents of Canada. The report covers both Canadian and foreign issues in equity and investment fund shares and debt securities.

Equity and investment fund shares include common and preferred shares and shares of investment funds. Debt securities include bonds and money market instruments. Bonds have an original term to maturity of more than one year. Money market instruments have an original term to maturity of one year or less.

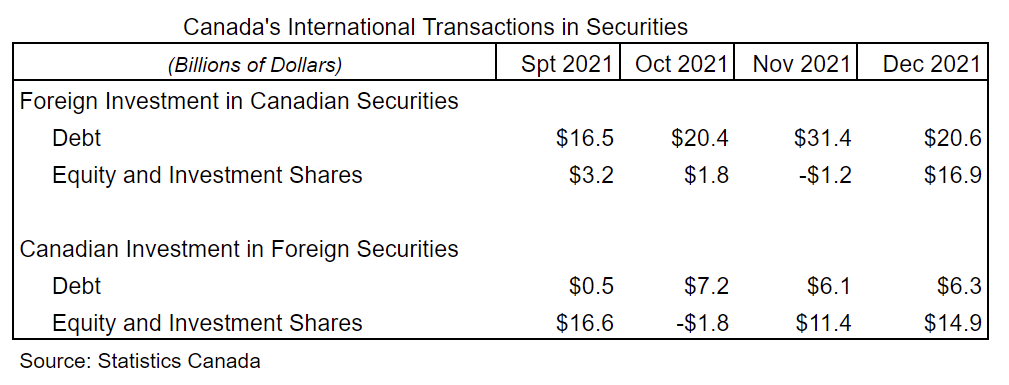

Foreign investors returned to the Canadian securities market in November 2021 acquiring a net total of $31.4 B of Canadian debt securities while shedding $1.2 B from their portfolios. Net foreign investment in November reached $30.1 B, the largest level of investment since April 2020. However this receded at the end of the year as foreign investors shed a whopping $10.8 B in Canadian debt securities.

The Canadian stock market bumped over November with the S&P/TSX starting off on November 1 at 21232 and climbing to a peak of 21646 by November 18 but then sliding down to finish the month at 20659 on November 30. Foreign investors took the opportunity to dump $823 M worth of Canadian shares and $458 M of Investment Fund shares from their portfolios, for the first time since September. However, by the end of December foreign investors overwhelmingly increased their investment in Canadian equities to $16.9 B despite the S&P/TSX peaking slightly lower, 21229, than in November.

Foreign investors shed off equity and investment fund securities and focused their attention on buying up debt securities, as Canadian long-term interest rates rose to the highest level since February 2019. Foreign investors bought $13.6 B in money market instruments and $17.7 B in bonds. Nearly half of all debt securities purchased were federal government issues, specifically 48.4% ($6.5 B) of all the money market instruments and 48.6% ($8.6 B) of all the bond purchases.

South of the border in the United States, the S&P 500 remained relatively flat during November with the index on November 1 at 4613 and climbing slightly to a peak of 4682 by November 15 but slightly falling off to finish the month at 4567 on November 30.

Meanwhile across the Atlantic in London, the FSTE 100 slightly rose in the first week of November starting on November 1 at 7288 and climbing to its monthly peak on November 11 of 7384 then falling to finish at 7059 by November 30.

While Canadian acquisitions tripled in November ($17.5 B compared to October $5.4 B), Canadians showed more interest in equity and Investment fund shares rather than foreign debt securities. Canadians purchased $11.4 B in equity and investment shares, of which $7.4 B were from the US with a focus on large capitalization technology firms and investment fund shares tracing broad market indices. The remaining $4 B of non-US foreign shares were mainly British companies’ shares.

US long-term interest rates lagged behind Canadian counterparts for November. As such, Canadian investors only purchased $6.1 B of foreign debt securities of which $4.3 B (70.4%) was bonds. It was US Corporate bonds that Canadians were more interested in, with $2.8 B being purchased, and the remaining $1.6 B of purchases being from US government-controlled businesses.

While foreign and Canadian investors’ interests seem to be opposite, foreign investors buying up more Canadian debt securities than equity shares and Canadian investors buying up more foreign shares than foreign debt securities. The year over year changes tell yet a different story.

Comparing January-November 2021 to January-November 2020, Canadians have vastly increased their investments in both foreign debt securities and foreign equity. Canadian investors purchased $46.5 B of foreign debt in 2021 which far exceeded the $1.5 B in 2020. Foreign equity and investment fund shares purchased in 2021 were $97.9B, exceeding $14.5 B from 2020. Clearly Canadian investors had more confidence in 2021 than they did in 2020.

Foreign investors, on the other hand, purchased approximately the same amount of Canadian debt securities in 2021 as they did in 2020, $149.9 B and $149.3 B respectively. However, foreign investor confidence in the Canadian markets returned in 2021. Foreign investors purchased $29 B of Canadian equity in 2021 versus selling off $20.9 B in 2020.

Both foreign investment into Canada and Canadian investors activities appear to be returning as COVID-19 restrictions are easing,however, with new variants, rising inflation, future interest rate hikes and the possibility of the outbreak of war in eastern Europe, growth in investor activity, whether Canadian or foreign, may not be as strong in 2022.

Gerard Lucyshyn is an economist and an economics lecturer in the Department of Economics, Justice and Policy Studies at Mount Royal University in Calgary, Alberta. He has also served as a business and economic consultant to a variety of industries. Gerard has authored a number of articles and research papers on municipal, provincial, federal and international economic and policy issues.