Like a bad memory we’d like to block out, many Canadians ignore or even scoff at the question of what their retirement will look like. For some, it is in the distant future, but for many, it is right around the corner.

More than 21.8% of the working population is close to retirement. This means one-in-five working Canadians are between the ages of 55 and 64. This will be the largest exodus from the Canadian labour market in its 155-year history which is certain to have major consequences for Canada’s labour markets, its productivity, its social programs, and its tax programs.

As Canadians emerge from the effects of the worst government intervention in history (resulting from the government’s attempt to control the most recent global pandemic), retiring Canadians and those remaining in the labour force need to think about their immediate future as the timeline for The Great Retirement has shortened, and its effects will become very apparent in the near future.

The shut-down measures and fiscal support instituted by all levels of government actually resulted in a very large increase in personal savings during 2020. Personal deposits in banks increased by $150 billion which exceeded the average pace of the previous decade by nearly three times. That is an increase of approximately $100 billion. The household savings rate peaked at 27.5% in the second quarter of 2020. The normal rate of household savings is generally around 4%. Canadians used their savings to pay down debt, purchase houses, and other financial assets and 33% retired earlier than they had intended.

At first blush, this may appear wonderful, especially for those who have retired or were placed in a better financial position than pre-pandemic. However, when one considers that 20% of the entire Canadian workforce is eligible to retire in the next 5 to 10 years, accelerating this rate may not necessarily be the dreamy vision many Canadians have about spending their golden years. In fact, some of the ramifications have already begun to manifest themselves in terms of a lack of workers, an embattled and overwhelmed healthcare system, rapid inflation, and unsustainable government pension systems.

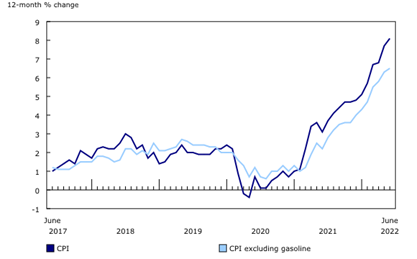

As the effects of the pandemic appeared to come under control, severe government restrictions began to relax and the economy started to rebound. The tagline used was a “reopening.” But the fact is governments unleashed two years of pent-up demand on a supply chain that had been devastated by COVID restrictions. The supply chain has been unable to catch up since. Excess demand and supply shortages have caused prices to increase across all categories of the consumer price index. The four categories that carry the most weight in the index have all increased by more than 5%. Canadians are paying 5.6% more for household operations, shelter prices have increased by 7.1%, food prices jumped up 8.8%, and transportation prices increased into the double digits, 16.8%, primarily led by a whopping 54.6% increase in gasoline costs. The provinces seeing the most inflation have been Prince Edward Island (10.9%), Manitoba (9.4%), and Nova Scotia (9.3%). The provinces with the lowest rates of inflation occurred in Nunavut (4.3%), Yukon (7.7%), British Columbia, and Ontario (7.9%).

Canada’s Consumer Price Index (CPI) 2017-2022

Source: Statistics Canada

An unfortunate side of unbridled inflation is the erosion of retirees’ fixed incomes, savings, and lifestyle, and Canadian seniors are worried. In a recent survey, more than 78 per cent of retirees surveyed indicated they are extremely concerned about the impact of inflation on their savings, their living expenses, and their future purchasing power, as well as, 48% are concerned about outliving their savings and the lack of a guaranteed income.

Canadian retirees’ concerns are rightly placed. Once adjusted for inflation, savings between February 2020 and December 2021 diminished by nearly 5% leaving Canadian retirees with approximately $10 billion less in purchasing power. Overall, Canadians saw a loss of $63.5 billion in purchasing power by December 2021. In fact, this shrinkage of purchasing power and concerns by Canadian retirees have trickled to the swell of Canadians who want to join their fellow Canadians in retirement, so much that they are now having second thoughts about retiring.

A recent survey of Canadians nearing retirement shows that 40% of them have delayed or plan to delay their retirement simply because they still have too much debt, while 60% have delayed retirement because they simply do not have enough savings or investments.

So just how much income per year is needed in retirement?

Obviously, the amount needed differs from individual to individual and largely depends on a number of factors, such as, what age you want to retire, where you want to live, do you plan to continue to work part-time, will you have other family members to support, do you still have a mortgage or other debt to pay down, do you have access to other sources of income (i.e. social security, pensions, etc.), your travel plans, your health and desired lifestyle in retirement.

Most financial planners’ general rule of thumb regarding retirement is you will need approximately 70% of your pre-retirement income. In 2021, the highest quintile (the top ⅕) of households had an annual median income of $178,100 which would translate into an estimated pre-tax-income during retirement of $124,000. The lowest quintile (the bottom ⅕) of households had an annual median income of $34,000 translating into an estimated pre-tax income during retirement of approximately $23,800 per year. The average annual household income was $54,630 which translates into an estimated $38,241 during retirement. The median pre-tax-income for senior families was $65,300 per year.

While most Canadians retiring are eligible to receive some retirement income from the federal government such as Old Age Security (OAS) and the Canada Pension Plan (CPP), the amounts only curb the amount needed.

The most you can receive annually from OAS and CPP combined is $20,770. To qualify for the maximum OAS benefit you will need to have lived in Canada for at least 40 years after the age of 18. To qualify for the maximum CPP benefit you must contribute to the CPP for at least 39 of the 47 years from ages 18 to 65 and you must have contributed the maximum amount to the CPP for at least 39 years based on the yearly maximum pensionable earnings (YMPE) set by the Canada Revenue Agency (CRA). For many Canadians, they do not qualify for the maximum and the average amount they receive is around $15,159 a year.

Additional Annual Pre-tax Retirement Income Needed

| Household Income

Quintiles (⅕) |

General Rule of Thumb with Average OAS/CPP | Additional Pre-tax Retirement Income Needed |

| Highest | $178,000 times 70% less $15,000 oas/cpp | $110,000 |

| Average | $54,000 times 70% less $15,000 oas/cpp | $23,000 |

| Lowest | $34,000 times 70% less $15,000 oas/cpp | $9,000 |

How much do you need to have to retire? The general opinion for an average pension is around $700,000. However, many financial advisors suggest more towards having $1 million to be on the safe side. While the rule-of-thumb and general opinions are useful, the reality is that 32% of Canadians between the ages of 45 to 64 indicate that they have no retirement savings, 19% have less than $50,000, for those who do have retirement savings have on average only around $184,000. Nearly 90% of Canadians don’t believe that they have enough savings for the lifestyle they want in retirement and 43% of women over 55 don’t have any retirement plan.

So the question Canadians nearing retirement can no longer ignore is, will your golden years be a boom or a bust?