The federal government is preparing a budget to be unleashed upon the public and the financial markets, sometime in March. Aside from being terrified at the prospect of a huge amount of debt being taken on, yet again, by our erstwhile servants on Parliament Hill,...

Results for "Fcpp.org"

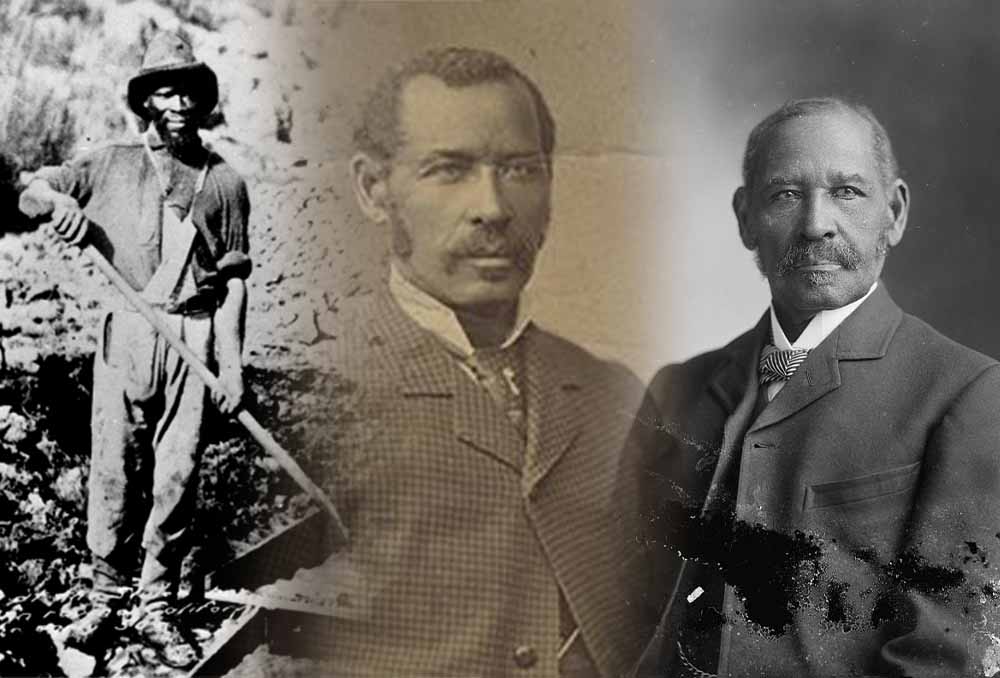

Profile Series: Mifflin Wistar Gibbs

Mifflin Wistar Gibbs (1823 – 1915) was a Canadian-American businessman, judge, lawyer, politician, and black rights activist. He was born and raised in Philadelphia, worked in San Francisco, then moved to Victoria. In 1866, he won a seat on City Council and became the...

Divesting YXE will Benefit Taxpayers

Divesting YXE will benefit taxpayers Saskatoon International Airport WINNIPEG, MB, March 6, 2021 - The Frontier Centre for Public Policy has just released Debt-Free, Few Capex Demands, Well Positioned to Soar: A Valuation & Strategic Appraisal of the Saskatoon...

RIP Social Licence to Operate

For several decades, Canada was the focus of a global attack on its natural resource economy, with its oilsands deposits (the world’s third-largest oil reserve) ranked as “public enemy number one.” Though only a tiny contributor to global greenhouse gas emissions...

Featured News

The Boomers’ Last Gasp

As this wave of the pandemic winds down, we should ask honest questions about our response to it. Although an accurate assessment of the lockdowns - closing schools and businesses - is months away, we need a plan to respond to a likely second fall wave. The Economist...

Provincial Governments and Hidden off the Book Debt

The province of Newfoundland and Labrador is staring bankruptcy in the eye. This is what we have heard in the news lately, and to be honest, it is not a fully incorrect assessment. As to the why, there is a mixture of reasons typical for provincial politics....

An Exclusive Interview with Czech President Vaclav Klaus

It is no surprise then that Klaus views global warming quotas and promises by politicians as a means of inflicting untested ideas “in the form of market controls” on the international economic engine. This, Klaus says, “gives new life to top down government and controls over people’s lives.”

The Smart Growth Bailout?

Yet the bottom line remains: Without smart growth’s land rationing policies, the severe escalation in home prices would never have reached such absurd levels. But the disaster in the highly regulated markets will be with us for years. The smart growth spike in housing prices turned what might have been a normal cyclical downturn into the most disastrous financial collapse since 1929. Now the taxpayers are being asked to bail out the mess that smart growth advocates, no doubt inadvertently, have created.

Rabbit In The Hat

The problem, of course, is that this process is repeated over and over again in all kinds of government transfers and “investments”, and the Canadian taxpayer ends up paying nearly 40% of his income in miscellaneous taxes. In return, he gets bad services, stupid subsidies, and a pile of regulations, controls and prohibitions.

Worst Among Equals? (PowerPoint Slides)

PowerPoint Slides from the Meeting for Policy Experts Seminar releasing the 2008 Canada Health Consumer Index.

Three Questions For Ontario Candidates

The vice is tightening on Ontario and unfortunately the federal government is doing much to help it close. Ottawa is still taking about $80 million every working day from Ontario to fund subsidies, including equalization, for Manitoba, Quebec and the Atlantic provinces.

Canada’s Healthcare Lags Far Behind Europe: Study

Story from The Canadian Press discusses the results of two studies released by FCPP: the Canada Health Consumer Index 2008 and the Euro-Canada Health Consumer Index 2008.

Canada Health Consumer Index 2008

The Frontier Centre and its Brussels-based partners at the Health Consumer Powerhouse release the 2008 Canada Healthcare Consumer Index, the first-ever national consumer-focused bench-marking of Canada’s provinces.

Media Release – Canadian Health Consumer Index Rates Each Province’s Healthcare System

Ontario came in first in the Frontier Centre for Public Policy’s first annual Canada Health Consumer Index which was released today. The Index - published by the Frontier Centre for Public Policy together with its European partner the Health Consumer Powerhouse (HCP)...

How Would You Spend $1 billion?

The Frontier Centre releases an “alternate choices” list for the cost of burying Saskatchewan’s carbon emissions